Buying a Passage

Purchasing a Passage involves the following:

Select an underlying asset from the drop-down menu (e.g. BTC)

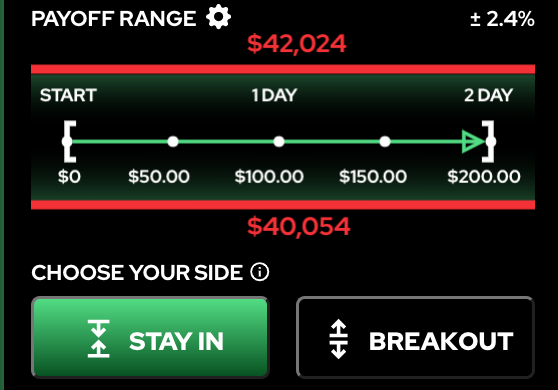

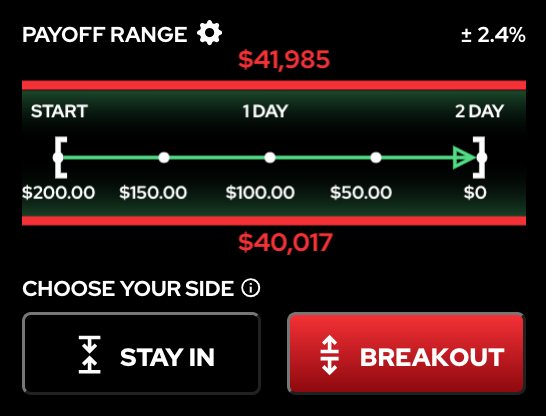

Based on the estimate range, decide if you believe the asset will stay in long enough to at least breakeven (1 day) or breakout faster than 1 day

The payoff range diagrams provided show the range of price as well as the linear payoff depending on the side of the trade the user takes

If you'd like to place a custom order, you can adjust using the ⚙️icon. See Order and Order Matching for more

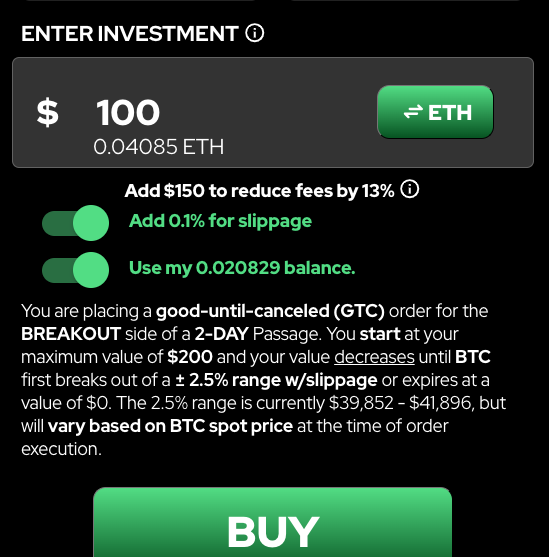

Specify the amount you would like to buy. This is denominated in the native coin of the chain (e.g. ETH for Arbitrum, BNB for Binance, etc.)

Claims are rewarded in the same asset used to invest

Select Slippage

You will also have the choice of applying "slippage" or a 0.1% amount that will be subtracted from the order placed. E.g., an order at ± 1.2% range w/slippage of 0.1% would match with an order at ±1.1%. Slippage is designed to improve order matching P2P.

Trade with existing balance

If you have funds on the smart contract that have not been withdrawn, Passage will ask you if you would like to use them toward a new trade. You can toggle this on or off.

Check out Passage MY TRADES in the USER GUIDES section to learn how to monitor your trades.

Last updated